What is the balance sheet ? Why is it needed at all, what is it talking about and how to read it? This post will be interesting to those who are far from accounting and analytical activities of their business.

It is no secret that many entrepreneurs conduct their activities from the point of view of accounting for their sources and property indirectly, so to speak, on the "eye" and not because there is no desire, but because there is no time and additional resources to deal with additional paperwork. All accounting activities are now mainly dictated by the audit and tax authorities, in order to properly maintain tax and accounting records.

In fact, the balance sheet is the most important and measurable criterion of a business, and it is for the one who runs it. This is, in fact, the only document that answers the question of how much everything you have costs. How much your property is worth today, was worth yesterday and will be worth tomorrow is the main a priori of your material well-being and wealth. And therefore, all the current activities of a normal business, household are carried out with the aim of its positive change, i.e. with the aim of multiplying what was at the time of its "origin". The balance sheet answers the question - have you increased your own well-being or decreased it for the entire time of work in a certain period.

The balance sheet does not necessarily have to be tied to entrepreneurship. For example, your household (your family) also has a balance, which is based on what you have (apartment, house, car, cottage, etc.) and what you bought it for (your money, gift or loan).

Consider the balance sheet not from the side of its formalized form and the stuffing of various lines (accounting accounts) on two separated sides, where on one side it is written ASSETS, and on the other LIABILITIES, and from the general understanding of what it is and how the ratio of sources and directions of their placement may change over time.

The main thing to understand is that the balance sheet, as strange as it sounds, is the balance of your sources (Liabilities) and where they are invested (Assets).

The simplified form of the standard balance sheet consists of 2 sections

- sources - LIABILITIES

- areas of use - ASSETS

In turn, the LIABILITIES are divided into 2 subsections:

- equity

- borrowed

and ASSETS on:

- non-current (equipment, buildings, transport, communications, etc.)

- current (raw materials, materials, products, money, debt, etc.)

Everything is natural, easy and simple here: sources can be own and borrowed, and where from these sources funds can be directed - it's either equipment, buildings, etc. or working capital, raw materials, stocks, etc.

Here is a simple example of creating and maintaining a balance sheet on the example of entrepreneur Petya's business.

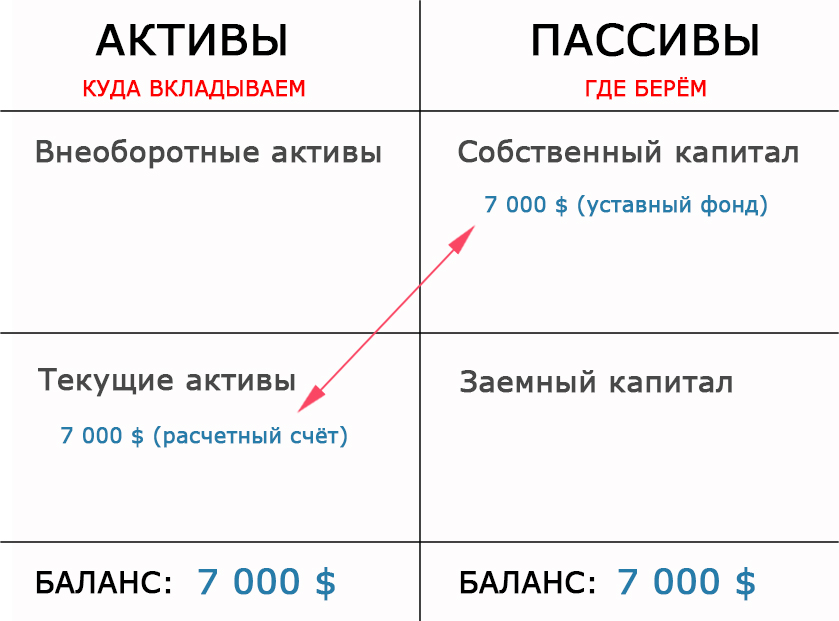

Petya decided to become an entrepreneur, he has his own $7,000 and this is his authorized capital, which he keeps on his checking account.

This is what the starting balance sheet of entrepreneur Petya will look like.

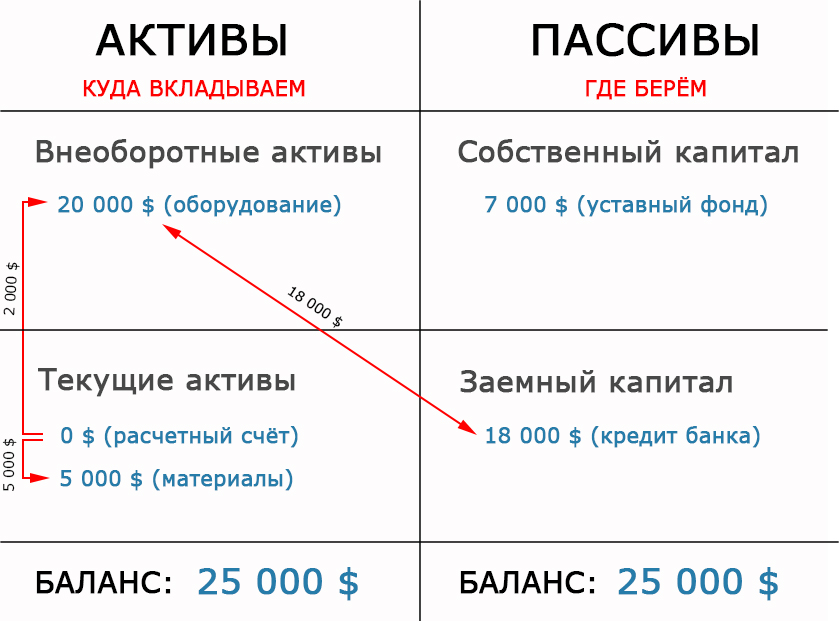

He wants to produce furniture and for this he needs to buy equipment and the material from which it will be made.

The equipment costs $20,000, and the material (wood) for the volume that Petya can process and sell (based on his production and marketing capabilities) within a month is $5,000.

But Petya has only $7,000, and everything needs $25,000, so Petya has to go to the bank and take out a loan of $18,000.

After these manipulations , the balance will take this form:

Three accounting entries will precede the balance sheet change after the operations performed:

- Credit 66 accounts Debit 01 accounts – $ 18,000 (the issued loan is directed to fixed assets – this transaction increases the total amount of the balance)

- Debit 01 accounts Credit 51 accounts – transfer money to fixed assets (asset redistribution operation – asset from one form goes to another)

- Debit 10 accounts Credit 51 accounts – we transfer money to the material /wood (the operation of asset redistribution – asset from one form goes to another)

Intermediate operations using correspondence 66, 51, 08 accounts in this case are omitted for a simpler understanding of the basics for beginners and the concept of the principle of constructing a simplified form of balance.

Petya's total wealth has grown to $25,000. But all this basically happened off the credit.

Two key indicators: the total balance is $25,000, there are $7,000 in it.

Petya agreed to return the loan to the bank in three years.

What happens during this period.

Petya produces furniture and sells it at prices that allow him to make a monthly profit of $ 800. In three years 12*3*800 = 28 800 $.

During this time, the equipment partially wore out and its cost became ($14,000). $6,000 of depreciation costs were written off to the cost price, which was successfully covered by revenue.

That is, the incoming revenue within the cost (costs) goes into circulation, with the exception of depreciation, which will "settle" on the settlement account along with the profit. In total, depreciation with profit form a net income - this is "free" money of Petya, with which he successfully repays the loan.

Three years later, the loan ($18,000) was repaid with depreciation ($6,000) and partially with profit ($12,000).

As a result, the balance of Petit took this form.

In the form of the remaining profit, Petya already has $16,800 on the settlement account.

Two key indicators: the total balance of $ 35,800, its own $35,800.

Well done Petya – he organized a very profitable business. In addition to the fact that the total amount of the balance sheet has grown by 40% in 3 years, and all sources and assets have become 100% his own. From $7,000, his own wealth grew to $35,800. Since Petya's business is so profitable, he may well reinvest the remaining profit in expanding his production capacity and thereby create a reserve in even greater growth of his organization.

We think from this example it is clear what the balance sheet is in its simplified form, what is its managerial function and relevance in assessing the financial and economic capabilities of the organization. Now it is clear why dynamics is very important in the analysis of the balance sheet.

In this post, we purposefully did not go into the details of the balance sheet accounts and the subtleties of their synthetic and analytical accounting, since this is another topic.

First of all, you need to understand that in the management of the organization, the balance is needed not for anyone who checks it, but for someone who owns it!

How to understand the balance sheet Somehow!

Лилия