Exchange rate difference - quite often you hear about it, especially in accounting. It can be seen from practice that many economists have a "purely" statistical approach to this indicator, although in management activities the exchange rate difference plays a fairly important role in financial and economic planning. To understand how it affects profit in accounting, it is necessary to understand its essence.

So what is the exchange rate difference? What is the "nature" of its origin and how it can affect the economic result of the organization's activities, we explain on our fingers.

The exchange rate difference is the difference in the value of both certain assets and sources recorded in a currency and arising in connection with the current change in the ruble exchange rate to this currency for a certain period. That is, the determining factor in the "allocation" of the exchange rate difference is the currency registered on both active and passive accounts.

For foreign currency assets, this revaluation is applied only until its form changes from monetary to tangible/intangible (raw materials, work in progress, software, etc.).

For example, while the currency is on the current account, the exchange rate difference will be taken into account during the change of its exchange rate. As soon as the currency changes to another form, for example, from the current account to the materials (D10 K51), the revaluation will no longer be applied to the materials. Or, foreign currency accounts receivable until its closure and transfer to a tangible asset.

For foreign currency liabilities, revaluation is applied until these foreign currency liabilities are closed in full.

For example, foreign currency accounts payable at each reporting date, until its full repayment, will be revalued at the current exchange rate (the exchange rate difference is displayed). Similarly, for foreign currency credit debt.

The only one! By its accounting policy, an organization can provide for the write-off of exchange differences, for example, on long-term foreign currency loans, to increase the cost of fixed assets for which they were purchased. In this case, for long-term foreign currency loans, the exchange rate difference will not be recorded separately.

The impact of exchange rate differences on the profit of the organization "follows" from their positivity and negativity.

When the value of a currency increases, positive exchange rate differences arise on active accounts (50,51,55 cash, 60 accounts receivable, etc.). On passive accounts, in the same situation, negative exchange rate differences are formed.

In a situation where there is a decline in the exchange rate, then a negative exchange rate difference appears on active accounts, and a positive one on passive ones.

- The essence of positive exchange rate differences is that they are aimed at increasing the profitability of the organization or increasing the share of equity in the total volume of all its sources. That is, eventually it will be written off to the 99 Profit account, or rather, on Credit, these are accounts where profit accumulates.

- The essence of negative exchange rate differences is that they are aimed at reducing the profitability of the organization or reducing the share of equity in the total volume of all its sources. That is, in the end, it will be written off to the 99 Profit account, or rather to Debit these accounts, where expenses and losses accumulate.

For a better understanding of the accounting of exchange rate differences, let's give a simple example.

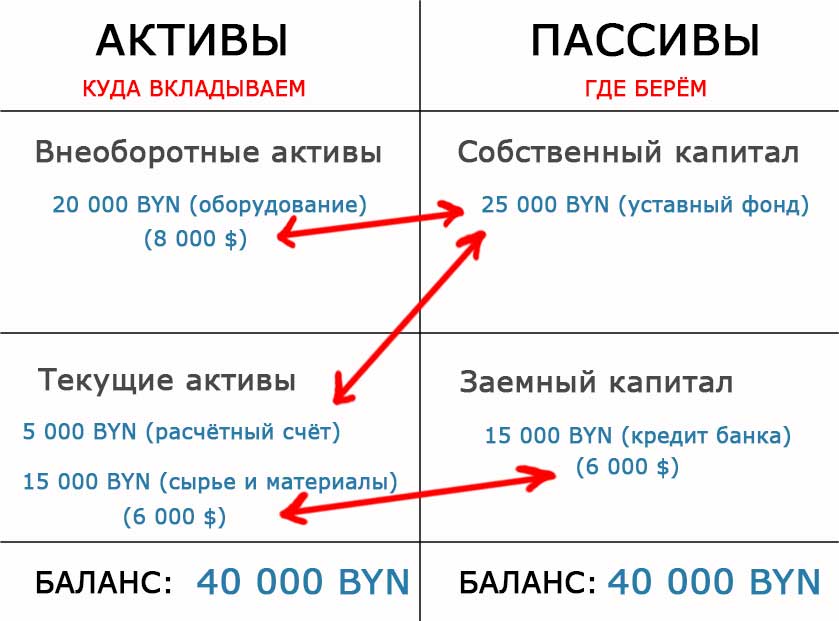

As of 01.01.2020, organization "A" has an authorized fund (source of equity) of 25,000 BYN, which it sent in rubles (BYN) 5,000 to the settlement account (asset), and the remainder, after the purchase of the currency (8$000) to pay for the contract for the purchase of equipment with delivery after a certain period (asset – accounts receivable). In addition, this organization takes a loan for the purchase of imported raw materials in foreign currency for $ 6,000. On 01.01.2020, the exchange rate of $ to BYN was 2.5 BYN per $.

The total amount of sources and directions (assets), taking into account the currency component in the balance sheet, amounted to 40 000 BYN.

A month later, the rate of $ to BYN increased and amounted to 3 BYN per $. What happened to the value of the organization, taking into account the currency structure of assets and liabilities on the new reporting date - 01.02.2020?

From balance sheet it can be seen that the active accounts of currency components (in this case, accounts receivable 8 000 $, which from 01.01.2020 at 20 000 BYN increased to 24 000 BYN on 01.02.2020 due to the growth of the dollar). This is an increase in the active account in correspondence with the credit of account 91 "Other income and expenses";(on liability) by 4 000 BYN and will create a positive exchange rate difference on accounting.

At the same time, on passive accounts of currency components (in this case, it is the debt on the bank's foreign currency loan of $6, 000, which from 01.01.2020 at 15, 000 BYN increased to 18, 000 BYN on 01.02.2020 due to the growth of the dollar). This increase in the passive account in correspondence with the debit of account 91 "Other income and expenses" (by asset) by 3 000 BYN and will create a negative exchange rate difference on accounting.

The total amount of sources and directions (assets), taking into account the currency component and the growth of the US dollar against BYN, in the balance sheet amounted to 47,000 BYN.

This is an intermediate balance. The balances of 91 accounts at the end of the year are usually reset by writing off exchange differences to the resulting accounts 99 «Profits and losses» and 84 «Retained earnings (uncovered loss)».

Write-off of positive exchange rate difference on profit:

D91 K99 – 4000 BYN

Write-off of negative exchange rate difference for loss/expense:

K91 D99 – 3000 BYN

The credit balance on the 99th account of 1 000 BYN indicates a profit for the reporting period, according to this example. Further, this profit of 1 000 BYN is written off to the account's K84 Retained earnings (uncovered loss)».

After these transactions, the final balance sheet will take the following form:

That's how, in general terms, on a simple example, the accounting of exchange differences is conducted.

Understanding the nature of the origin of this revalued value of foreign currency assets and liabilities, it is possible to competently plan the financial and economic activities of the enterprise, calculating additional profitability or loss reduction from a properly formed currency structure of the loan portfolio and assets of the organization.

Of course, in accounting, with "unfair management", exchange rate differences can also participate in various manipulations on accounting for the profit of the reporting period, reducing the tax base, etc.

Accounting for exchange rate differences - Something like that!