What is it and how to count using the example

The online calculator for calculating IRR (internal rate of return - GNI) allows you to quickly determine the break-even interest rate for an investment project being implemented, taking into account its calculation horizon and cash flow.

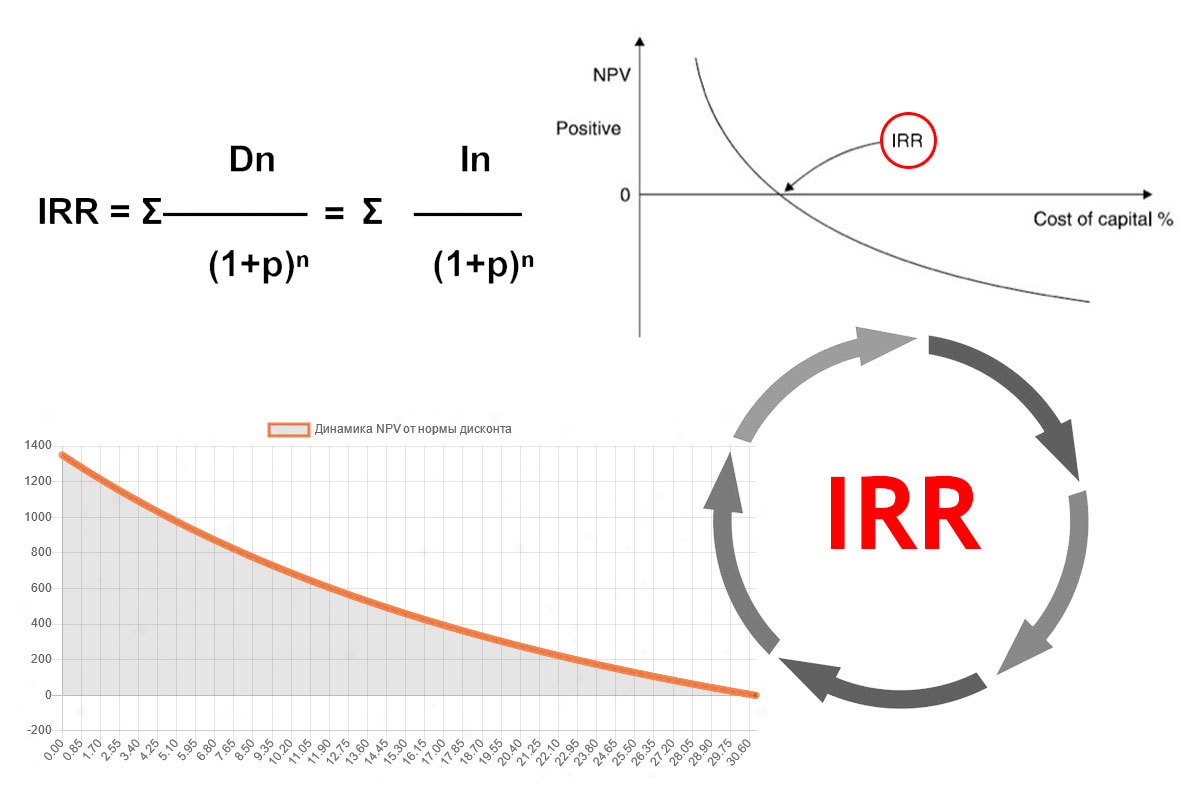

Based on the iterations performed when calculating IRR, a graph of the dynamics of changes in net discounted income (NPV) to the discount rate is plotted.

Graphically, it is possible to estimate the margin of safety between the discount rate chosen by the investor for the project and the IRR, relative to the NPV received.

IRR allows you to find out the maximum allowable discount rate (discount rate) at which the project can work at a break-even level (NPV/NPV equal to 0 for the entire calculation horizon).

The comfort zone for an investor is a rate below the IRR level at which NPV has a positive value. The fewer risks are included in the bid, the higher the real profitability of the project. IRR is an extension of these risks, in which there is any economic sense in the implementation of an investment project.

Specify the calculation horizon, adding for each year of the investment project the cash flow values - INFLOW and OUTFLOW, and make an online calculation of the internal rate of return (GNI) for the project – IRR.

Example of calculation using the calculator ›››

It is necessary to calculate the internal rate of return of the project - IRR.

The calculation horizon is 7 years. Cash in $.

We specify the values of OUTFLOW and INFLOW of money for each year of the project in accordance with its flow and make the calculation.