Everyone "points" at the American national debt and complains that Americans are worse off than we are and therefore not everything is really that bad.

And in general, why is there such close attention to him, especially among those who are trying to find something better than others in economic terms?

In fact, you need to understand this!

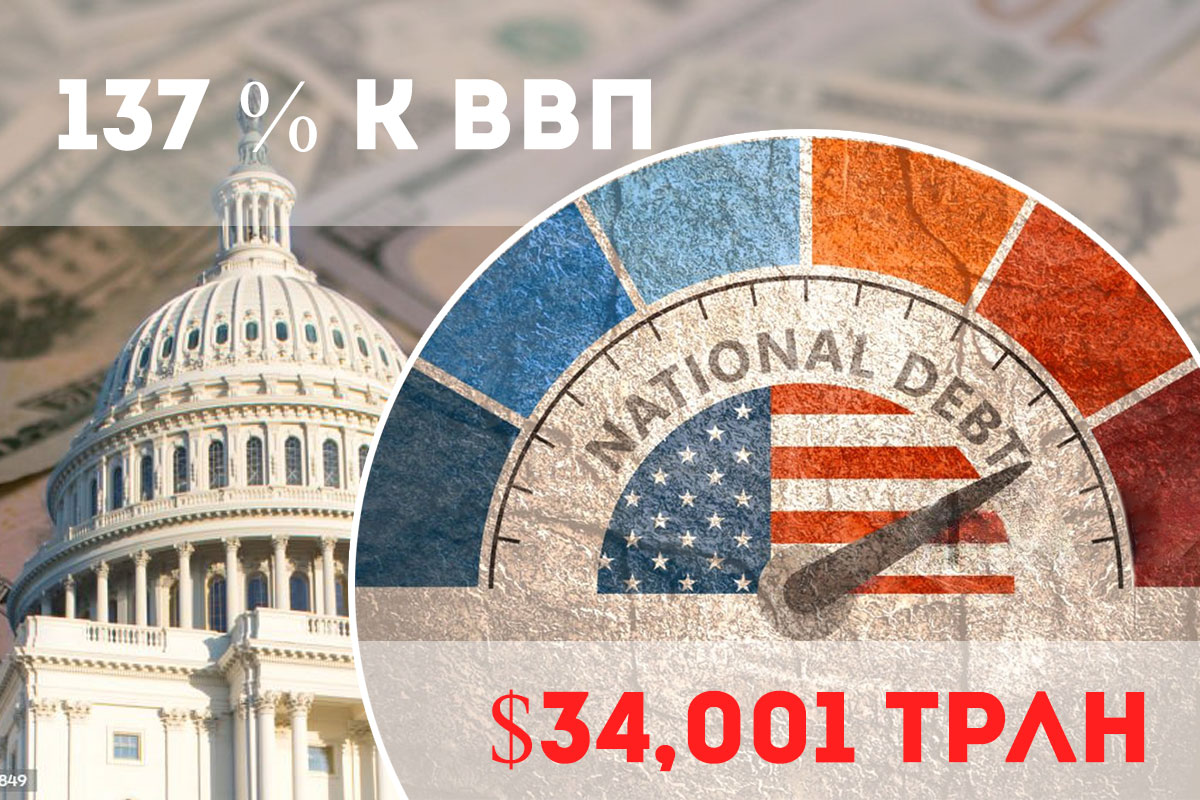

The state debt of the United States currently stands at $34.001 trillion, which is 137% of US GDP.

Frankly speaking, this is not a good level of economic autonomy of this country, but to a greater extent not because there are so many debts to GDP (although this is important), but because there is a constant trend, so to speak, in the "mountain" of this indicator in recent years.

The debt burden of the state usually, if it is impossible to settle it with its creditors, contributes to the declaration of default and as a result, the loss of the country's investment rating, capital outflow, transfer of property against debts. And this is a shortage of liquidity, which means high rates within its economy and the resulting economic stagnation.

That is, in theory, if Americans produce less than they can give back, then this pattern should have led to a logical default long ago, given such unchanging dynamics and the ratio of total debt to GDP. But this is not happening, and among other things, the limit bar is constantly being increased by the US Congress, as if the American monetary authorities are not aware of the consequences of these games.

Why is there no default in the USA?

And it's all about the structure of this public debt, which few people mention, i.e. to whom exactly and how much money the US government owes.

Foreign holders of American government debt (external debt) account for only 24.5%, and the remaining 75.5% is accounted for by domestic holders of debt securities.

So external creditors are:

- Japan ($1.2 trillion - 3.5%)

- China ($1 trillion - 2.9%)

- Great Britain ($0.6 trillion - 1.7%)

- Cayman Islands ($0.3 trillion - 0.8%)

- Luxembourg($0.3 trillion - 0.8%)

- Switzerland ($0.3 trillion - 0.8%)

- Belgium ($0.3 trillion - 0.8%), etc.

Internal creditors:

- banks

- local governments in the USA

- pension funds

- investment funds

- insurance companies

- ordinary citizens

As it turns out, the level of foreign borrowing among Americans is actually not so high, which is the main trigger for launching default processes. But domestic debts are exorbitant, due to which the United States is currently suffering from unbridled inflationary processes within its own country, which forces the Fed to constantly raise the interest rate and reduce the program of repurchasing its debt securities (treasury bonds) from creditors, thereby trying to reduce the level of excess money supply in its economy.

That is, the consequences of printing dollars to cover their domestic needs for the US government are absolutely clear, as are the methods of dealing with them. They printed the surplus and took it back from their economy after a while.

Due to the fact that the financing of external needs (war, aid, etc.) is dispersed at the global level and does not affect the consumer price index within America in any way, such a scenario does not pose a particular danger to the latter, such as, for example, pouring money into their economy.

And in general, sometimes a logical question arises - why should Americans borrow from someone from the outside (creating the appearance of these 25% of external borrowings to the total amount), when they can freely cover this need with the same printing press.

Therefore, as long as the global liquidity of the dollar in the world takes place, printing additional dollars, including on the side (external financing), will not pose any danger to the United States, as well as the same "dangerous" default for them.

Among other things, the United States has recently become the largest state holder of bitcoin in the world. Probably just in case. Why would that be?