On March 16, at the next meeting, the US Federal Reserve System, against the background of high inflation (7.9%), raises the interest rate on the dollar to 0.5%. It would seem that there has been a tightening of monetary policy (PREP) and, together with the gradual reduction of the quantitative easing program, the dollar should strengthen worldwide.

What is happening now

The markets practically did not react against the background of the news about the tightening of the PREP – all major US indices, not only fell, they increased to 5% (Dow Index, Jones S&P 500, NASDAQ-100), including the price of oil, gas and crypto assets. Although, these measures are aimed at reducing monetary liquidity in the economy (to remove money from the economy to stop inflation)!

That is, the measures taken by the US monetary authorities (the US Federal Reserve) could not bring down the inflation rate.

This suggests that the level of money supply in the world is such that an increase in the interest rate by 0.25% of a point is "zilch", relative to the really necessary level of its increase.

It is not for nothing that the Fed plans to organize its gatherings on this issue seven more times in 2022.

In other words, using the example of prices for hydrocarbons. In conditions of limited oil and gas supplies (under the conditions of sanctions pressure), the market began to experience a shortage of them and their prices logically increased.

BUT!

This means that the current demand can maintain such a price level, and the consumer is still willing to pay such a price for it. That is, there is an excess amount of dollars on the market and the increase in the rate on them in no way, in fact, did not affect prices continued to rise. Although, in conditions of falling liquidity (the transition to savings due to an increased rate), the opposite should happen.

All this suggests that the American authorities underestimate the scale of inflationary processes.

In the near future, the Fed will be forced to raise even more significantly the interest rate until the price stabilizes /falls, which will be a signal that the goal has been achieved.

And this fall can be significant and possibly instantaneous (bubbles will burst). This applies to absolutely everything, including the Russian and Belarusian rubles.

So far, the situation for Russian hydrocarbons against the background of Americans' loyalty, primarily to their economy, allows Russia to support its budget, balance of payments and, of course, the ruble.

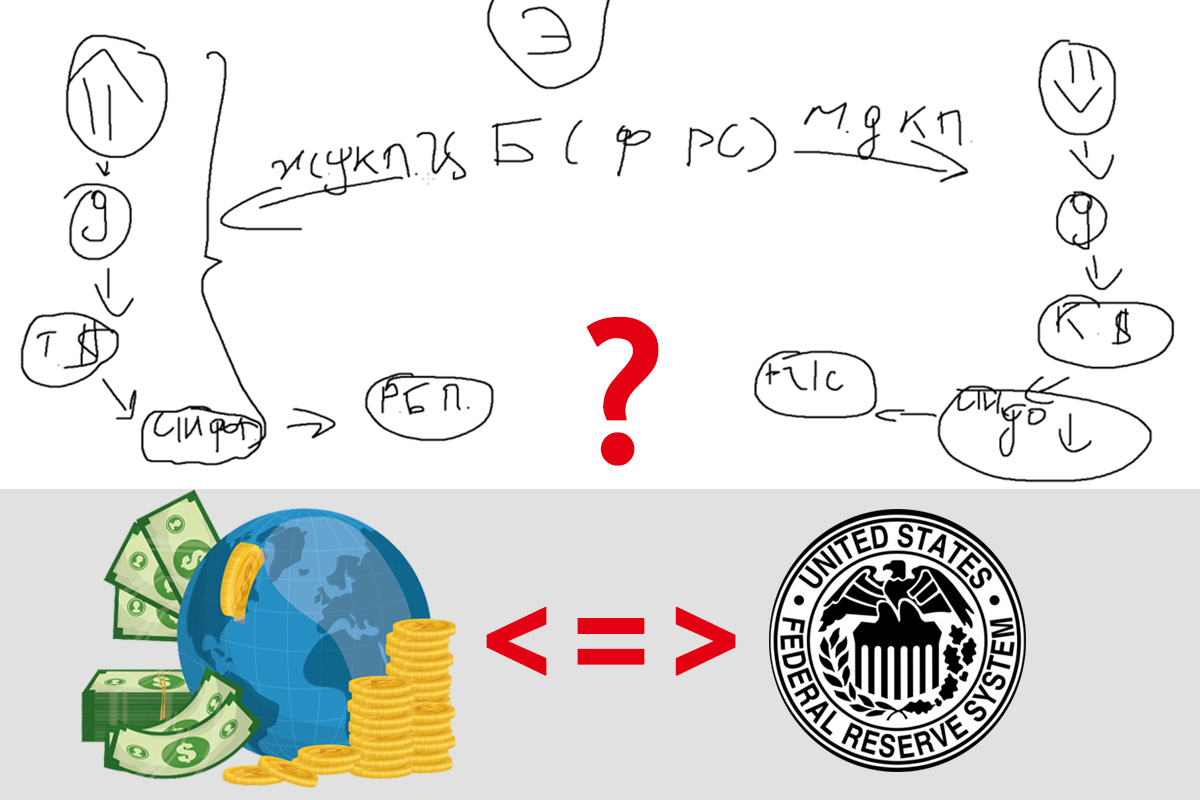

Simple layout on the fingers- expert opinion of a professional trader: how the economy is regulated and what will happen next:

How the economy is regulated: what is happening now and why the US Federal Reserve cannot stop inflation - Somehow!