Without too much analysis and pathos - is it really, as analysts write, on the whole, the company is doing well.

What catches your eye?

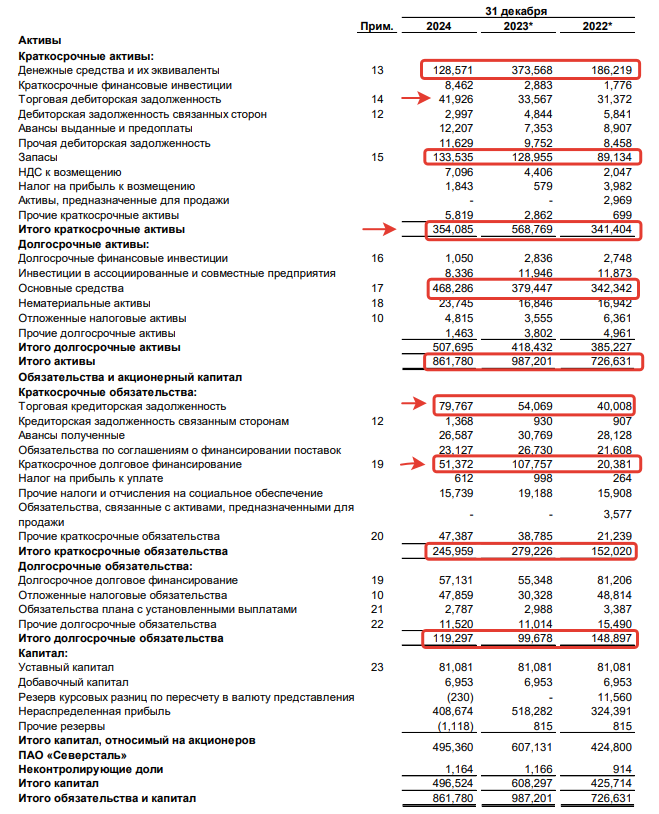

We immediately note a decrease in Severstal's capitalization with a decrease in capital autonomy (the share of equity in the company's assets). The capitalization of assets decreased by 126 million rubles from 2023 to 2024, while debts in assets increased by 10% (from 38% to 42%), which indicates a certain negative trend.

The total cash liquidity from the balances of 2023 was reduced by 245 million rubles, which is more likely to indicate a redistribution of assets to the investment component (an increase of 89 million rubles is seen from the balance sheet).

The positive aspect is that the value of non-current assets is growing due to liquid assets, rather than "air" - an invented indexation (additional fund).

There is also a noticeable decrease in short-term debt obligations by 56 million rubles. (from 107 million to 51 million), but at the same time there is an increase in accounts payable by 25 million rubles (from 54 million to 79 million), which, in the absence of an increase in current assets and the presence of high interest rates on the market, may indicate a redistribution of current debts to finance the investment program, rather than turnover. This, in turn, may indicate that Severstal is betting not on current profits, but on long-term development.

Obviously, the bet is on tomorrow, not today.